The road to recovery for the global economy seems drawn out two years after the Covid19 broke out. A global economic rebound in 2022 has been predicted by many, although there is consensus that recovery may be uneven across countries. There is a genuine fear that recessionary ripples from some countries in the Global North may trickle down to the South in ways that may spark major economic turbulence if the pandemic, and its tentacled fallouts, are not reigned in soon.

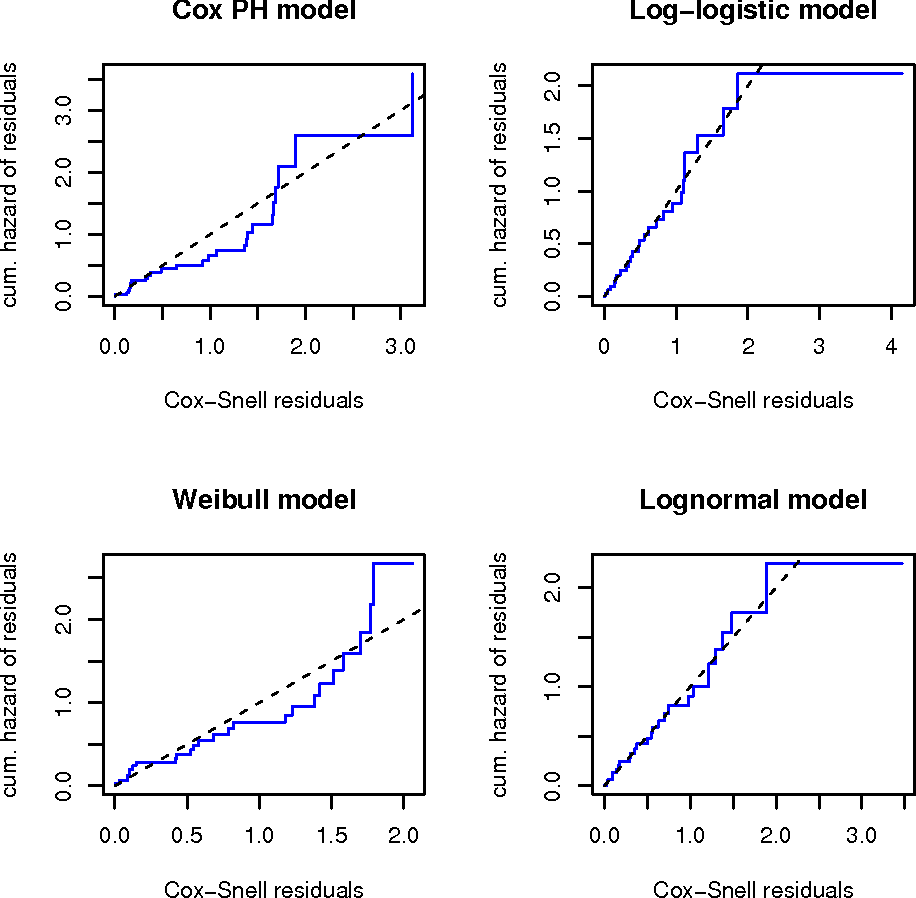

This study presents some parametric models in survival analysis, specifically, the accelerated failure time model. Furthermore, we investigate the applicability of this model in analyzing insurance attrition using life insurance data. Based on the Akaike information criterion, the generalized gamma model provides the best at for the data.

This study examined the determinants of life insurance demand in the Northern region of Ghana using primary data on 200 sampled customers and potential customers of life insurance companies in the Tamale metropolis (the Northern regional capital). The preliminary results showed that, the average insurable age in the region is 33 years with an average economic dependency of 3 persons.

Anecdotal evidence indicates a surge in growth of remote work in Ghana even before the onset of the Covid19 pandemic. For some service-sector SMEs in Ghana – particularly professional service businesses – cutting back on recurrent expenditure such as office rent and related expenses was always a necessary tactic to offset lower margins on fees and increases in direct costs of doing business.

Every marketer knows that customer insights should form the foundation of their product and marketing plans. Yet when I talk to marketing leaders at startups, they tend to balk at the idea of devising and executing thorough market research plans given resource constraints. Framing the survey results in this way enables your team to understand how your work can drive meaningful change throughout the organization.