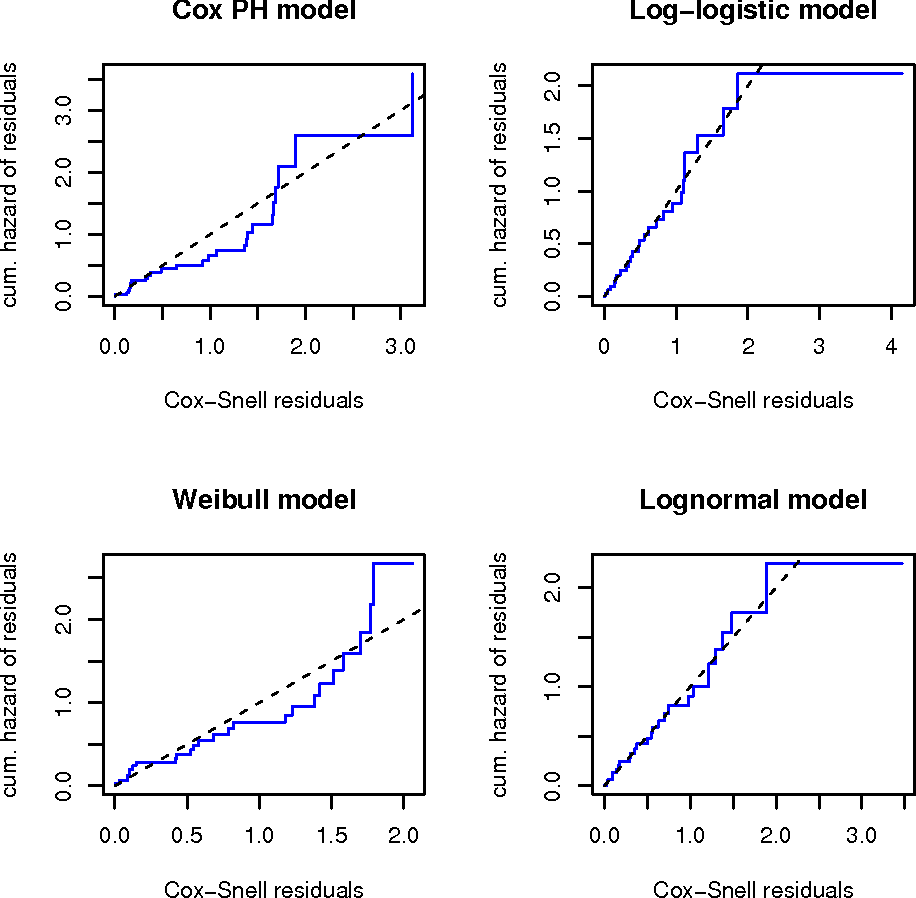

This study presents some parametric models in survival analysis, specifically, the accelerated failure time model. Furthermore, we investigate the applicability of this model in analyzing insurance attrition using life insurance data. Based on the Akaike information criterion, the generalized gamma model provides the best at for the data.

This study examined the determinants of life insurance demand in the Northern region of Ghana using primary data on 200 sampled customers and potential customers of life insurance companies in the Tamale metropolis (the Northern regional capital). The preliminary results showed that, the average insurable age in the region is 33 years with an average economic dependency of 3 persons.

Anecdotal evidence indicates a surge in growth of remote work in Ghana even before the onset of the Covid19 pandemic. For some service-sector SMEs in Ghana – particularly professional service businesses – cutting back on recurrent expenditure such as office rent and related expenses was always a necessary tactic to offset lower margins on fees and increases in direct costs of doing business.